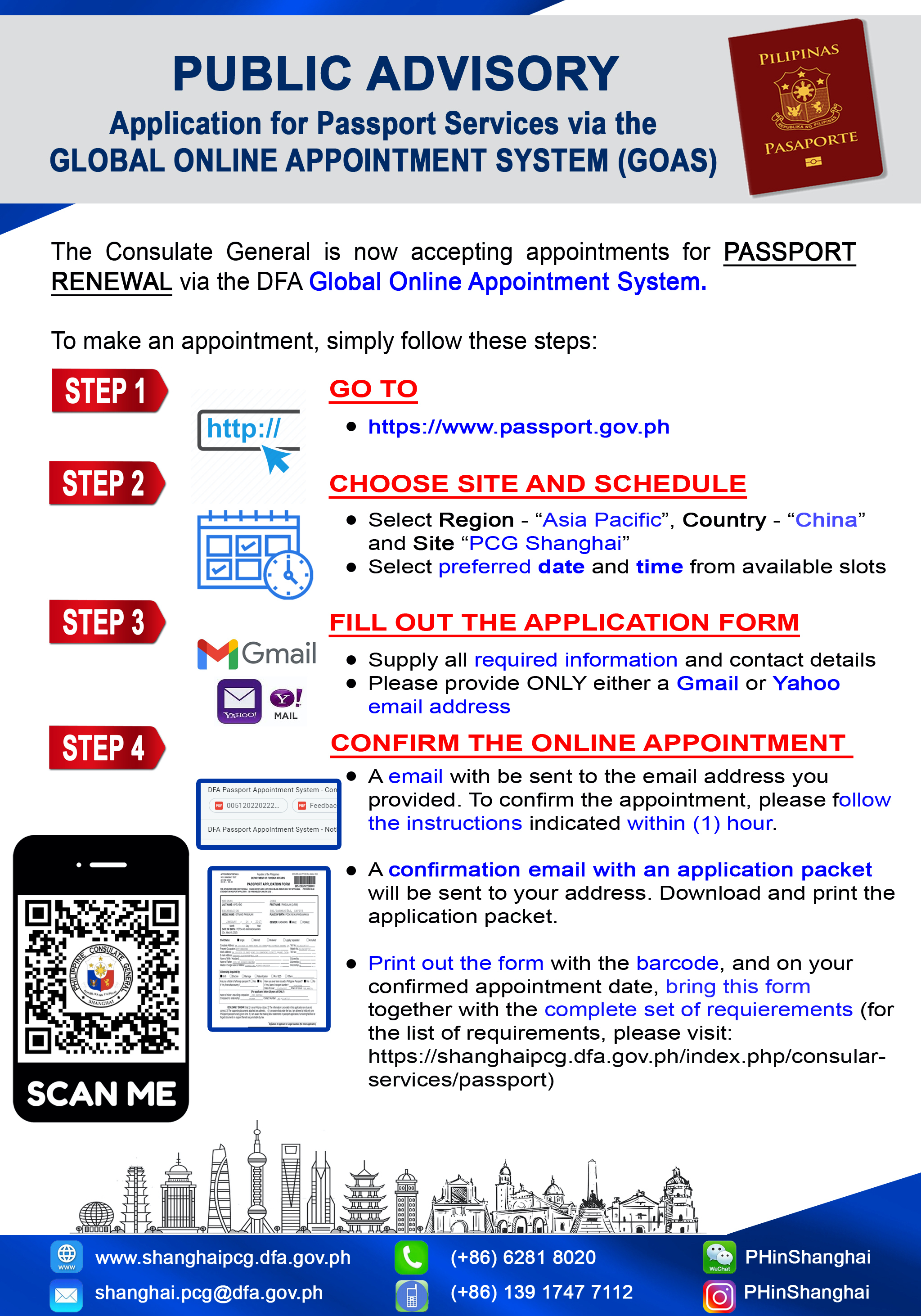

Consular Services Appointment System

TNK Webinar plants seeds of Agribusiness entrepreneurship among Shanghai Filipinos

Shanghai – Over a hundred overseas Filipinos in Shanghai and surrounding provinces gained crucial know-how on diving into agribusiness in the Philippines during the Trabaho, Negosyo, Kabuhayan (TNK) webinar on June 11.

The Webinar is the second of the TNK series co-organized by the Philippine Trade and Investment Center-Shanghai (PTIC) and with local Filipino organization The Filipino Teachers in Shanghai (TFT).

Featured resource speakers from the Department of Agriculture (DA) were Philippine Agricultural Counsellor in China Ana GM B. Abejuela, Executive Director Jocelyn Alma R. Badiola, OIC Assistant Director Antonieta J. Arceo and Supervising Agriculturist Ludivina Rueda.

The Webinar covered key topics for prospective and budding agribusiness entrepreneurs. DA’s experts provided profile of the Philippine agribusiness sector and shared tips on starting an agribusiness enterprise. A rundown of specific investment windows followed, covering Philippine export champions, the agribusiness value chain and specific priority commodities.

Participating OFWs also welcomed the briefing on the DA’s various training programs, e-courses, learning sites and extension services in the Philippines, as well as credit facilities such as the Agrinegosyo (ANYO) for OFWs keen on venturing into the sector.

Opening the webinar, Consul General Josel F. Ignacio urged participants to consider becoming overseas Filipino investors (OFI) in agriculture, a key pillar of the Philippines’ growth strategy. Closing the event, Philippine Trade and Investment Center Vice Consul Mario C. Tani underscored the value of agricultural and agribusiness investments in underpinning Philippine food security amidst pandemics, climate change and economic upheavals. END

Paggunitâ ng Punong Konsulado ng iká-124 Taóng Kaarawan ng Pagpapahayág ng Kasarinlán

SHANGHAI, 12 June 2022 – Maalab na nakiisá ang Punong Konsulado sa Shanghai sa paggunitâ ng sambayanán sa iká-124 na Taón ng Pagpapahayág ng Kasarinlán ng Pilipinas.

Sa gitnâ ng patuloy na paghihigpít sa Shanghai sa malakihang pagtitipon bilang pag-iingat sa COVID-19, isáng payák na palátuntúnan ang idinaos ng mga kawanì sa pangunguna ni Consul General Josel F. Ignacio. “PAGSUONG SA HAMON NG PANIBAGONG BUKAS” ang gabáy-nilay ng pagdiriwáng sa kasalukuyang taón.

Matapos ang Pambansáng Awit at panunumpâ sa Watawat ay pinakinggán ang pahatíd na pagbatì ng Pangulong Rodrigo Roa Duterte at ng Kalihim ng Ugnayang Panlabás Teodoro L. Locsin, Jr.

Nagbigáy-pugay si Kalihim Locsin sa mga kababayang nasa ibayong-dagat bilang “source of pride and inspiration”. Ani ng Kalihim, “we, in the Department of Foreign Affairs, did not let a pandemic stop us from cultivating foreign partnerships, securing much-needed vaccines, upholding our sovereign rights, getting overseas Filipinos out of distress, and sharply increasing already considerable consular services”.

Nagbahagì namán si Consul General Ignacio ng halaw mulâ isáng makasaysayang talumpatì: “The Philippine independence of 1896 was too brief. Our independence of 1946 was quickly misused and finally betrayed. In 1986, independence came purely by Filipino effort. That independence had to be won from fellow Filipinos. I want today to be a day of celebration. A celebration commemorating the past sacrifices and noble achievements of the Filipino people in the cause of freedom and independence, a celebration of people power, power that can assure that freedom and independence for all time.” END

TNK Webinar coaches Shanghai Filipinos on Franchise Entrepreneurship Fundamentals

Shanghai – Engendering an entrepreneurial mindset and seizing opportunities in PH’s burgeoning franchising sector took the spotlight at the first session of the Trabaho, Negosyo, Kabuhayan webinar series held on 4 June. Over 100 Filipinos attended.

Organized by the Philippine Trade and Investment Center-Shanghai (PTIC) and local Filipino organization The Filipino Teachers in Shanghai (TFT), the webinar featured resource speakers from the Philippine Franchise Association (PFA).

PFA Chair Sherrill Ramos Quintana provided an overview of the work of the PFA and a snapshot of notable trends in the Philippines’ rapidly expanding franchising landscape.

President Sam Christopher Lim covered the fundamental elements and benefits of franchising. He shared valuable advice on evaluating franchisors and the commitment expected from franchisees. Especially well-received were his tips tailored to overseas Filipino workers on making sound franchise investment decisions and on avoiding pitfalls.

Keynoting the event, Consul General Josel F. Ignacio urged Shanghai OFWs to become overseas Filipino investors (OFI) as well. He cited franchising as a viable and tested business model by which remittances can both raise OFW families’ living standards but with an added powerful multiplier effect that contributes to the larger economy. The well-attended webinar saw the participants engage the speakers in a lively exchange in the ensuring open forum. END

Keynoting the event, Consul General Josel F. Ignacio urged Shanghai OFWs to become overseas Filipino investors (OFI) as well. He cited franchising as a viable and tested business model by which remittances can both raise OFW families’ living standards but with an added powerful multiplier effect that contributes to the larger economy. The well-attended webinar saw the participants engage the speakers in a lively exchange in the ensuring open forum. END

Emergency food assistance delivered to 247 Filipinos in Shanghai

Shanghai, 10 May – A total of 247 Filipinos across Shanghai received emergency food packs in a delivery effort that took place on 7-9 May.

The food packages are part of Welfare Assistance being extended to Filipinos most affected by the weeks-long lockdown in Shanghai. It is supported by Assistance-to-Nationals (ATN) Funds approved by the Department of Foreign Affairs on the recommendation of the Consulate General.

Each beneficiary received essential food items such as rice, eggs, vegetables, fruits, and cooking oil. For a taste of home, the package also included a selection of Philippine-branded canned fish and meat products, noodles, soup mixes, sauces, biscuits and condiments that are locally available in China via companies such as Lianyugang Dawn Trading Co. Ltd. and Century Pacific China’s Shanghai office.

In an act of solidarity, Philippine company Liwayway China Co. Ltd. of Oishi fame donated snack items to round up the package.

Organized into four teams, Consulate General personnel and Filipino volunteers worked round the clock to track, coordinate and troubleshoot deliveries with the third-party logistics provider during the three-day period, amidst lockdown restrictions.

From preparation to execution, the emergency food assistance was helmed by the Philippine Consulate General in a collaborative effort with the Philippine Trade and Investment Center-Shanghai, and in consultation with the Philippine Department of Tourism Office and leaders of Filipino Community organizations.

The food packages were well received by the beneficiaries, with many conveying their appreciation and delight via messages, photographs and even videos. Word about the food packages also made its way onto social media platforms, drawing positive comments from Chinese and other foreign nationals.

The food packs are part of a larger DFA-supported assistance effort that offered prospective beneficiaries a choice between emergency food packs or food vouchers. Registration was via a mobile phone application tailormade for the assistance effort.

A further round of registration for these forms of assistance is due to be launched soon.

The Consulate General acknowledges the valuable assistance of CITEM Business Representative in China Mr. Raymond Tan for supporting PTIC-Shanghai in the search for reputable and reliable suppliers. The Consulate General also appreciates the inputs during planning and execution provided by community leaders Ms. Michelle Teope-Shen, Mr. Joe Santiago, Ms. Annie Yap, Mr. Mark Ibañez, Ms. Jill Hilasque, Ms. Grace Bautista, Mr. Noe Estrella, Mr. Noel Caligagan, Ms. Gemma Calope, Mr. Herbie Recato, Mr. Aristotle de Leon, Ms. Marjorie Andes and, in the nascent stages, the Philippine Chamber of Philippine Chamber of Business and Professionals in Shanghai.

The Consulate General acknowledges the valuable assistance of CITEM Business Representative in China Mr. Raymond Tan for supporting PTIC-Shanghai in the search for reputable and reliable suppliers. The Consulate General also appreciates the inputs during planning and execution provided by community leaders Ms. Michelle Teope-Shen, Mr. Joe Santiago, Ms. Annie Yap, Mr. Mark Ibañez, Ms. Jill Hilasque, Ms. Grace Bautista, Mr. Noe Estrella, Mr. Noel Caligagan, Ms. Gemma Calope, Mr. Herbie Recato, Mr. Aristotle de Leon, Ms. Marjorie Andes and, in the nascent stages, the Philippine Chamber of Philippine Chamber of Business and Professionals in Shanghai.

The Consulate General extends appreciation to Mr. Agrix Go for lending his expertise and for his crucial work toward developing the mobile application platform for the registration of beneficiaries.

The Consulate General conveys its appreciation to Mr. Larry Chan and Liwayway China Co. Ltd. for the company’s contribution of products. END